The Greatest Guide To Matthew J. Previte Cpa Pc

The Greatest Guide To Matthew J. Previte Cpa Pc

Blog Article

Matthew J. Previte Cpa Pc Things To Know Before You Get This

Table of ContentsMatthew J. Previte Cpa Pc Things To Know Before You Get ThisThe 8-Minute Rule for Matthew J. Previte Cpa PcWhat Does Matthew J. Previte Cpa Pc Mean?Getting My Matthew J. Previte Cpa Pc To WorkThe Facts About Matthew J. Previte Cpa Pc UncoveredUnknown Facts About Matthew J. Previte Cpa Pc

Tax laws and codes, whether at the state or federal degree, are also made complex for many laypeople and they change frequently for many tax professionals to stay on top of. Whether you simply require somebody to aid you with your service revenue tax obligations or you have been charged with tax scams, employ a tax lawyer to aid you out.

The Only Guide for Matthew J. Previte Cpa Pc

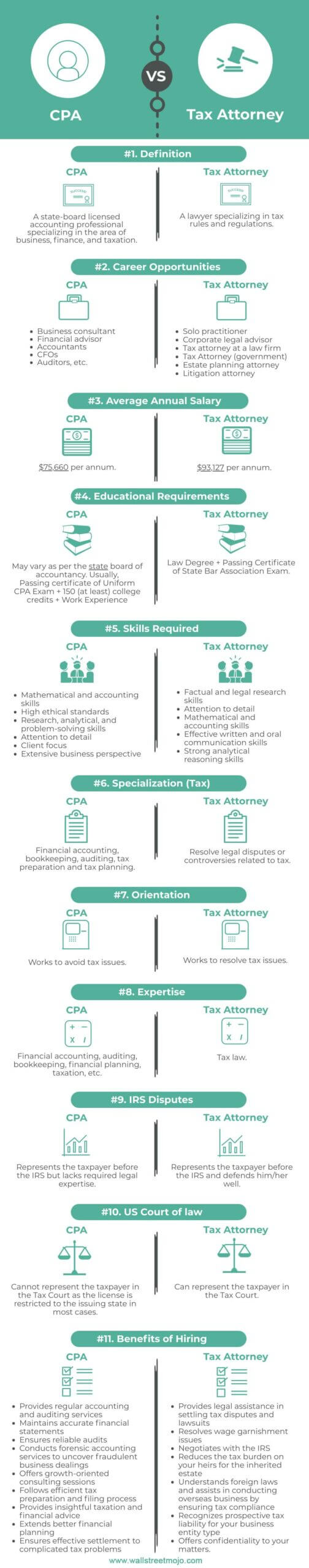

Every person else not only disapproval taking care of taxes, but they can be straight-out scared of the tax obligation companies, not without factor. There are a couple of concerns that are constantly on the minds of those who are handling tax obligation issues, consisting of whether to work with a tax attorney or a CERTIFIED PUBLIC ACCOUNTANT, when to hire a tax attorney, and We intend to aid answer those concerns below, so you understand what to do if you discover on your own in a "taxing" circumstance.

A lawyer can represent clients before the IRS for audits, collections and charms but so can a CPA. The large distinction below and one you require to bear in mind is that a tax obligation legal representative can give attorney-client benefit, indicating your tax legal representative is exempt from being compelled to indicate against you in a law court.

The Buzz on Matthew J. Previte Cpa Pc

Otherwise, a certified public accountant can affirm versus you even while helping you. Tax obligation attorneys are more aware of the various tax settlement programs than a lot of Certified public accountants and recognize how to pick the very best program for your case and exactly how to obtain you qualified for that program. If you are having an issue with the IRS or simply inquiries and issues, you need to employ a tax lawyer.

Tax obligation Court Are under investigation for tax fraudulence or tax evasion Are under criminal examination by the internal revenue service Another crucial time to employ a tax obligation lawyer is when you get an audit notification from the internal revenue service - Unfiled Tax Returns in Framingham, Massachusetts. https://nowewyrazy.uw.edu.pl/profil/taxproblemsrus1. A lawyer can connect with the internal revenue service on your part, exist throughout audits, help work out negotiations, and keep you from overpaying as a result of the audit

Component of a tax lawyer's responsibility is index to keep up with it, so you are shielded. Ask about for a knowledgeable tax attorney and inspect the net for client/customer testimonials.

3 Easy Facts About Matthew J. Previte Cpa Pc Described

The tax obligation lawyer you desire has all of the best credentials and testimonies. Every one of your questions have actually been answered. Due Process Hearings in Framingham, Massachusetts. Should you employ this tax obligation attorney? If you can manage the fees, can accept the kind of prospective solution used, and have self-confidence in the tax attorney's capability to help you, after that yes.

The choice to work with an IRS attorney is one that ought to not be ignored. Attorneys can be very cost-prohibitive and make complex issues needlessly when they can be solved reasonably quickly. As a whole, I am a large supporter of self-help legal services, specifically offered the selection of informational material that can be discovered online (including much of what I have released when it come to tax).

Matthew J. Previte Cpa Pc Fundamentals Explained

Here is a quick list of the issues that I think that an Internal revenue service attorney ought to be hired for. Criminal costs and criminal investigations can destroy lives and bring extremely major repercussions.

Wrongdoer fees can likewise carry additional civil penalties (well beyond what is common for civil tax issues). These are just some instances of the damage that also just a criminal cost can bring (whether an effective conviction is eventually acquired). My factor is that when anything possibly criminal occurs, even if you are just a prospective witness to the issue, you need a seasoned IRS lawyer to represent your rate of interests versus the prosecuting firm.

This is one circumstances where you always need an IRS lawyer watching your back. There are many parts of an IRS attorney's job that are relatively routine.

The Facts About Matthew J. Previte Cpa Pc Uncovered

Where we make our red stripes though is on technological tax issues, which put our complete ability to the examination. What is a technical tax obligation problem? That is a difficult inquiry to address, however the finest means I would describe it are matters that call for the specialist judgment of an IRS lawyer to solve appropriately.

Anything that possesses this "reality dependence" as I would certainly call it, you are mosting likely to wish to bring in an attorney to talk to - tax attorney in Framingham, Massachusetts. Also if you do not retain the services of that lawyer, an experienced perspective when dealing with technological tax issues can go a long way toward recognizing problems and settling them in a suitable manner

Report this page